What to do if you have bad credit and are short of money? Micro loans can help you!

In Hong Kong, financial difficulties can affect anyone, including those with bad credit. Whether it is an unexpected medical bill, home repairs, or urgent personal matters, obtaining a micro loan can provide necessary relief. However, it can be tricky for people with bad credit to find the right loan options. Fortunately, there are various solutions available for those who want to get a loan regardless of their credit history.

Micro loan options for people with bad credit

Micro loan options for people with bad credit

As a popular choice for people with bad credit in Hong Kong, these lenders usually offer fast, simple applications and more flexible loan criteria than traditional banks. Some of the most well-known online lenders include:

• WeLend: An online platform that provides personal loans, including micro loans for people with bad credit. Their application process is simple and loan approval is usually faster than traditional banks.

• Lendela: Also an online loan platform, it connects borrowers with multiple loan partners, making it easier to find a suitable loan even with bad credit. Due to the flexible repayment terms, Lendela is a good choice for micro loans.

Real Case: Jane, a 33-year-old Hong Kong resident, was struggling with medical expenses after a sudden illness. Since her credit score was not ideal, she applied for a small loan from WeLend. She was able to apply online, get approved in less than 24 hours, and get funds quickly, which helped her manage her medical bills.

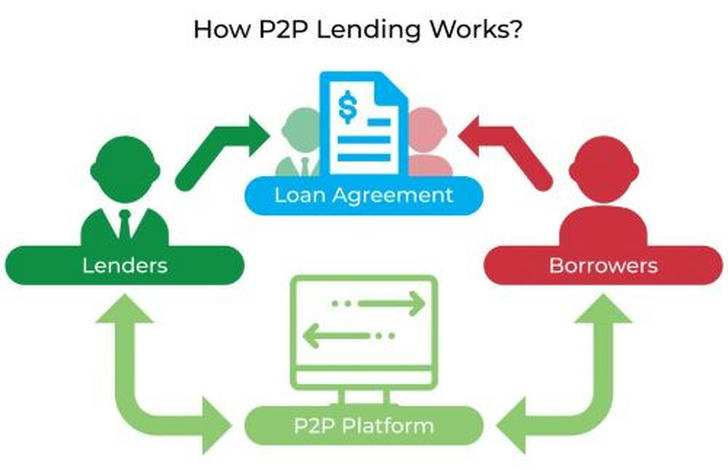

P2P Lending

P2P lending platforms in Hong Kong have become a solution for those with bad credit. These platforms allow borrowers to connect directly with individual investors instead of traditional financial institutions. Some well-known P2P lenders in Hong Kong include:

• Funding Societies: This platform connects borrowers with investors willing to lend small amounts of money. Even with bad credit, P2P loans are usually easier to qualify for because the risk is spread across many investors.

• P2P Options on WeLend: In addition to traditional lending services, WeLend also connects borrowers with P2P lenders to provide more flexible loan options.

Real Case: Kevin, a 40-year-old entrepreneur, needed a small loan to fund the cash flow of his business. Despite his poor credit score, he was able to get a loan through Funding Societies, which helped him stabilize his business finances.

Consolidation Loans for Bad Credit

If you have multiple debts, a consolidation loan can help simplify your finances. These loans allow you to combine multiple loans into one more manageable monthly repayment. While bad credit may result in higher interest rates, consolidation loans are often an effective solution to reduce overall financial stress.

Real Case: Sarah, an office worker in Hong Kong, was struggling to pay off several personal loans and credit card debts. She applied for a consolidation loan through a small lender that specializes in serving bad credit clients. By consolidating her debts, she reduced her monthly payments and was able to pay off her debts faster.

Quick Loans from Licensed Money Lenders

For emergency cash needs, quick loans from licensed money lenders are an option. While these loans often have higher interest rates than traditional loans, people with bad credit can get them. It's important to make sure you borrow from a licensed money lender to avoid illegal loan sharks, which may charge high fees and interest.

Real Case: Tom, a student in Hong Kong, needed urgent cash to pay his tuition. Despite his poor credit record, he was able to obtain a small short-term loan from a licensed moneylender. Although the interest rate was high, the quick loan disbursement helped him pay his tuition on time.

The process of applying for a loan for people with bad credit

1. Understand loan options

People with bad credit can choose from different types of lenders, including traditional banks and non-bank lenders. Non-bank institutions usually have looser credit record requirements, but the interest rates may be higher.

2. Prepare application materials

Applicants need to prepare some basic documents, including:

• Hong Kong identity card (such as identity card or passport)

• Recent proof of address (such as utility bills or bank statements)

• Proof of income (such as payroll, bank passbook, etc.), some non-bank institutions may waive income proof.

3. Submit a loan application

After choosing a suitable lender, you can submit a loan application through its official website, mobile app or in person at a branch. In the application, you need to fill in your personal information, financial status and loan amount, etc.

After the loan application is submitted, wait for review. After the review is passed, you can sign the contract and then repay the principal and interest on time.

Loan welfare policies in Hong Kong

While bad credit can limit your loan options, there are several government-backed welfare policies that can help individuals with financial difficulties:

Comprehensive Social Security Assistance (CSSA)

CSSA provides a safety net for individuals facing extreme financial difficulties. Although CSSA is not a loan, it can provide financial support to those who are unable to work due to health conditions, family circumstances, or other factors.

Public Rental Housing Scheme

For low-income residents, the Hong Kong government provides public rental housing at subsidized prices. This policy helps free up resources for other financial needs and relieves the pressure of borrowing.

SME Financing Guarantee Scheme

If you are a small business owner with bad credit, the Hong Kong government provides financial assistance through the SME Financing Guarantee Scheme. The scheme helps businesses obtain loans by providing guarantees, making it easier for businesses to obtain funds even if they have bad credit.

Conclusion

Don't worry about being a bad credit person in Hong Kong. The government will also help you when you need money urgently. Multiple welfare policies are provided as support to reduce your financial burden. As long as you take the right approach, bad credit will not be an obstacle to getting the financial help you need.